Why summer is a good time to move… School’s officially out for summer! If you’re like us, you’re probably thinking beaches, holidays, cottages… any activity that will get us out to enjoy the warm weather…but it can also be a perfect time to move! While there might not be as much real estate activity in July as there is in May, it may surprise you to find out that June, July and August are busy months in Ottawa real estate, especially in recent years. The weather is fine and there are still a lot of great opportunities to buy

Read More

Archives for Buyers

Buying a Home: What The Extras Cost

Contracts and rentals to consider in home ownership When it comes to buying a home, there are always additional fees to be considering when you make an offer. Typically, a first-time home buyer needs to be aware of the costs associated with buying a home – legal fees, mortgage rates, home insurance, closing costs, property taxes, land transfer fees…But what about those little extras not everyone considers? The contracts and rentals associated with the home such as furnaces, hot water tanks, and in some locations even your septic tanks – and what that could cost you. The main point is

Read More

What Home Buyers Should be Looking for When Viewing a Property

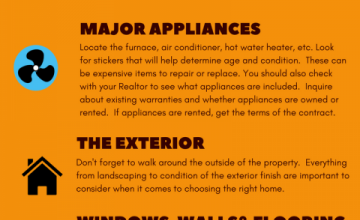

You’ve done your research, found the perfect Realtor, crunched the numbers, created your list of must-haves and now it’s time to start the exciting process of HOUSE HUNTING! When you’re looking at homes for sale it isn’t always easy to look beyond the cosmetics. Not to worry, we’ve created this handy graphic to help home buyers to stay focused.

Read More

What Home Buyers Should be Looking for When Viewing a Property

You’ve done your research, found the perfect Realtor, crunched the numbers, created your list of must-haves and now it’s time to start the exciting process of HOUSE HUNTING! When you’re looking at homes for sale it isn’t always easy to look past the cosmetics. Not to worry, we’ve created this handy graphic to help home buyers to stay focused.

Read More

All About Homeowner’s Associations

When looking to buy a home, there are many options. Last week, we took a look at condos as compared to freehold properties but what about a freehold home with a homeowner’s association? In many cases, a homeowner’s association can appear very similar to a condo but this is not actually the case. It is very important to understand these differences before buying into a home with a homeowner’s association. Differences Between a Condo and Homeowner’s Association If you purchase a condo, you are purchasing your unit along with a share of the common element(s). These could include green spaces,

Read More

All About Condos

When it comes time to buy a home, more and more people are making the decision to buy condos instead of a freehold home. Condos can be a great option if they match up with a buyer’s lifestyle, but it is important to do your research and know the differences between a freehold home and condo before you make the final decision of which to purchase. There are many different types of condos but they all have one thing in common: shared ownership of at least one common element. This element could be the building itself, in the case of

Read More

Buyers Toolkit – Springtime

Buyers Toolkit – Springtime Spring is in the air, and the real-estate market is ramping up for the beginning of buyers’ season. Things tend to move faster in the spring and houses for sale are often sold shortly after they are listed. As a potential home buyer, it is important to be prepared as possible before you start looking at potential homes – that way, the chance of losing your “dream home” to another buyer is greatly decreased. You may be wondering … “What are some of the important things that can help you stay on-top of, and ahead of

Read More

New Mortgage Rules – Renewing and Refinancing

New Mortgage Rules – Renewing and Refinancing January 1st, 2018 Canada’s new mortgage rules came into effect and it was big news. These new rules appear to have the greatest impact on those looking to qualify for a new mortgage but if you are looking to renew or refinance your mortgage, you may be impacted as well. At the centre of the new rules is a stress test requiring applicants to qualify at a rate at least 2% higher than the rate they will be paying, regardless of the down payment they are making on the home. The new rules

Read More

SPRING into ACTION: Buyers

BUYERS Spring hasn’t begun to crack through the winter thaw, but that doesn’t mean there’s time to wait if you’re planning on purchasing a home this spring. Be prepared for the Spring Market, and ensure your home buying experience is a great one by organizing your paper work, mortgages, ideal houses, and pricing ahead of time. Spring into this home-buying season ready to buy, so that house you’ve been dreaming of, doesn’t land in the hands of another buyer. Credit Check A credit score is a numerical representation of your credit report, and having good credit is like gold when

Read More

Buying without a Realtor

Buying a house is a big investment, so it is natural to look for ways to save money wherever possible. Some buyers and sellers may assume that they can stretch their budget further if they handle the entire purchase themselves. Doing this may seem like a good way save you money, but can also lead to problems and higher costs in the long run. As a buyer, hiring a Realtor typically does not cost you a cent; your Real estate agent will be paid from the commission on the sale of the home. Hiring a professional who is on your

Read More