When you decide to buy your first home, the initial excitement is often quickly followed by fear of the unknown. After viewing many attractive properties online, you have no idea where to start. Eventually, though, with the invaluable assistance of a real estate agent, you can purchased your dream home at a great price. Those who have experienced a number of property transactions realize just how many reasons they have to be thankful for the trusting relationship they developed with their agent. First, the money and time you save far exceeds the agent’s commission. From planting the For

Read More

Archives for Buyers

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive

Read More

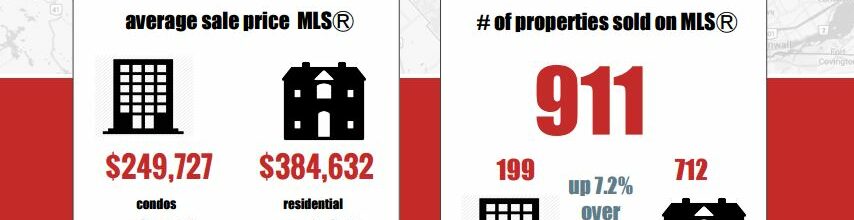

Real Estate Snapshot February 2016

What a difference a day makes! An extra day in February saw 46 sales on that day (February 29th) as per the Ottawa Real Estate Board’s news release March 3rd. See the full Ottawa Real Estate market snapshot for February and the full story from the Ottawa Real Estate Board below. With spring around the corner, we’re starting to see more homes come on the market, if you’re thinking of selling now is a great time to get your home listed with a real estate professional. While statistics are useful in establishing trends they should not be used as

Read More

Saving Strategies for Every Age

We all want to save more money, but doing it requires a plan. And, the best approach to saving depends on the stage of life you’re in because each phase has unique financial commitments. Although individual circumstances vary, these generation-specific suggestions will point you in the right direction. Millennials (19-35) Millennials, born between 1980 and 1996, are actually better than Gen Xers at money management, according to financial journalist Vera Gibbons. But, they tend to live in the moment and prefer instant gratification to long-term financial planning. And, because personal finance is not a core subject in

Read More

Don’t tax my dream campaign succeeds

The efforts of the Ontario Real Estate Association (OREA) and the Progressive Conservatives were recently rewarded when the provincial government decided they would NOT be expanding the municipal land transfer tax program. Liberals keep election promise In an unexpected announcement during the legislature’s question period, Municipal Affairs Minister Ted McMeekin ended concerns that the Liberals would break their election campaign promise and allow other cities and towns to introduce the tax. “There has been no call, at all, for a municipal land transfer tax,” he said, “nor is there any legislation before the House that would allow

Read More

8 steps to getting started in property investment

This propertyinvestment.com post from Nila Sweeney is an excellent primer for those who want to start a property portfolio. First, check your finances to see how much you can invest and get mortgage pre-approval. Then, define what success means for you, as well as the level of risk you are comfortable with, and set your goals. Next, start budgeting and create a purchase plan. Finally, research the market for opportunities that meet your criteria and approach them as business transactions, applying logic rather than being swayed by your emotional attachment. To read more click here. Source: Blog

Read More

An Economist’s Letter to Millennials Who Can’t (Yet) Buy a Home

This post from Jonathan Smoke, chief economist at realtor.com, explains what Millenials can do to help themselves along the path to home ownership. For example, a high debt burden will restrict their ability to qualify for a mortgage, and the amount they can get, so they need to limit their total debt payments (student loans, credit cards, car loans, etc.) to less than 15% of their income. Smoke also covers the importance of improving their credit score, saving as much as they can for a down payment and creating an emergency fund for unexpected bills. To read more click here.

Read More

The 3 Most Common Reasons a Home Inspection Kills a Deal

In this Redfin.com post, home inspector Dylan Chalk underscores the importance of a home inspection by identifying how they can prevent a potential sale. The most common reason is the home is not what it appears to be, especially in the case of a “flipped home”, one purchased and updated with the intention of making as much profit as possible. The inspection reveals there are more repairs and updates than the buyer expected. Problems with the core systems of a “fixer” house (foundation, frame, roofline, floor plan, drainage and access) add cost and complexity to the new homeowner’s projected

Read More

Is It Time to Downsize? Ask Yourself These 4 Questions First

If you’ve reached the time of life where you are contemplating downsizing your home, the first question to ask, according to this Realto.com post, is what kind of lifestyle do you want after downsizing? By defining how you want to live, you can narrow your search and focus on housing that will meet those requirements. For example, if you want to escape the bluster of winter and relax on a beach, local climate conditions and geography will drive your hunt. Or, if you like social activities, you would seek active adult communities where you can interact with like-minded

Read More

What’s the best property type for your first home?

Inexperience can cause first time home buyers to be confused by the multitude of available options. This post by Caroline James is an excellent introduction to the advantages and disadvantages of five popular property choices: a large detached house on a suburban block, a small home on a sub-divided lot, a townhouse, an apartment in a small block and an apartment in a high rise block. To read more click here. The post What’s the best property type for your first home? appeared first on Team Realty. Source: Blog

Read More